Aera Group reports Q1 2023 results.

26 April 2023

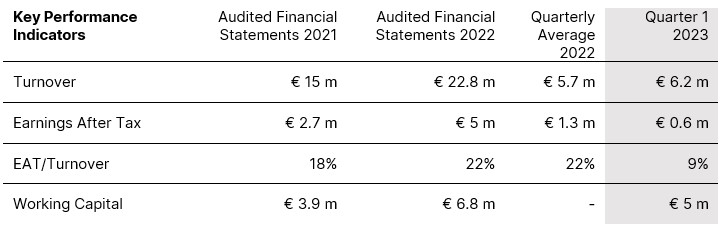

Paris – April 25th, 2023 – Aera today announced its first quarter results for 2023. The company published a revenue of €6.2 million, up by 9% compared to the quarterly average of 2022, and a net profit of €0.6 million.

Q1 2023 Highlights

Aera delivered 0.9 million carbon credits (12 projects) from Jan 1st to Mar 31. The timing of the carbon credits issuance from the international standards are still a bit erratic but we are closely monitoring the process to ensure that the expected carbon credits get issued over the year.

Aera closed 16 contracts during Q1 2023. Around 0.5 million carbon credits were purchased and 1.5 million carbon credits were sold. The market remains volatile and a wait-and-see stance characterizes secondary markets where liquidity is less. Nevertheless, the outlook remains good as significant transactions have been secured ahead of this current economic context and should materialize in 2023.

Quarterly revenue in Q1 2023 remains stable compared to 2022 quarterly average. Despite the current economic climate, Aera remains resilient and continue to provide customer satisfaction.

On the profitability side, there are a couple of factors adversely impacting the net results in Q1. A few deliveries of carbon credits sold have not materialized due to delays by standards in the issuance process. Nevertheless, we expect the numbers to normalize during the year when the expected carbon credits are issued.

Comments

Fabrice LE SACHE, Chairman of Aera Group SAS (AERA)

“2023 is a crossroad for voluntary carbon market. We have seen a rapid change during Q1 where long term buyers are not willing to do the race to the bottom. They want to support projects that ensure multi years operations. That means a robust carbon price signal. Consistency in price, liquidity, stability, is what we need. The debate on methodologies or quality/integrity, shall not overshadow the urgent action necessity. Carbon finance is today the most powerful lever to engage private sector, to drive investments and revenues towards low carbon technologies. Building a bridge from voluntary market to regulated markets might be a way to answer all of this.”