Aera Group announces its results for the 2nd quarter of 2023.

20 July 2023

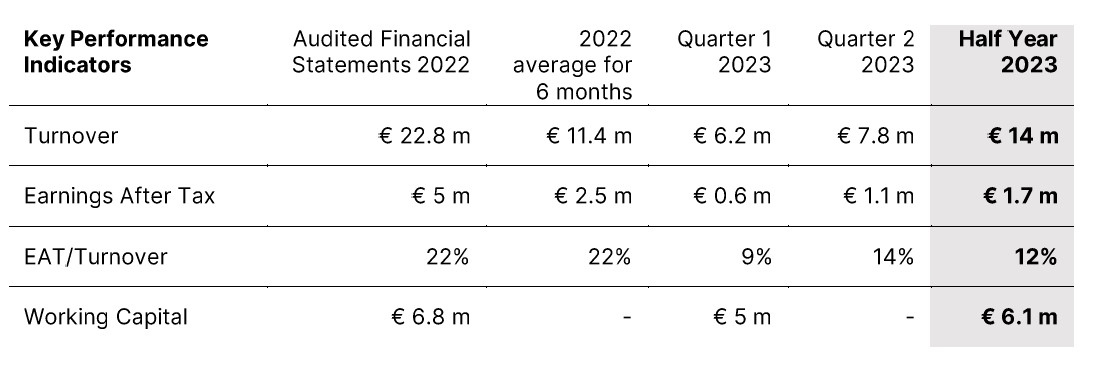

Paris – July 20th, 2023 – Aera today published its interim financial results as of June 30, 2023. Revenue for the second quarter of fiscal year 2023 amounted to 7.8 million euros. Over the first six months of the year, revenue is up by 23% compared to the 2022 average, to reach 14 million euros. Net profit after tax amounted to 1.1 million euros during the 2nd quarter and 1.7 million euros for the 1st half of the year.

Q2 2023 Highlights

Aera delivered 1.2 million carbon credits (9 projects) from April 1 to June 30. The schedule for issuing carbon credits from international registries has improved significantly compared to last year. With effective control and systematic monitoring by our certification team, we are positive on several other emissions expected by the end of the year.

Aera concluded 4 contracts during the second quarter of 2023. Around 0.9 million carbon credits were sold and there were no further purchases during this quarter. It should be noted that 26 million carbon credits were purchased last year and further long-term purchases will be considered depending on market conditions. The current global economic climate has slowed demand in the short term and we are focusing on contracted deliveries where a margin is already secured.

Revenue for the 1st half of 2023 is 23% higher than the average for 2022 over six months. This is the result of the commercial strategy between Q3 2021 and H1 2022 with particularly dynamic market conditions; period during which important forward contracts were signed.

With regards to the net result, we anticipate a significant increase in the 2nd half due in particular to the delivery operations to be carried out relating to the carbon credits available at June 30.

Comments

Fabrice LE SACHE, Chairman of Aera Group SAS (AERA)

“The first half of 2023 shows that Aera continues to grow despite an adverse market context. Our hedging strategy has proven to be solid for this turbulent time. Diversification in countries, technologies, standards, commercial structures and different layer pricing cautiously built over the years are indeed useful tools during a period of uncertainty. The strong and trustworthy relationship developed with large buyers is also a deep support. We are not competing in a race to the bottom but to enhance the market with higher price signal to achieve the quality we all care about.”